Introduction

Legal and financial terms can be confusing, especially when they sound related or appear in similar situations. One of the most common points of confusion is cash vs surety, particularly in legal, construction, and insurance contexts. Many people assume these terms are interchangeable because both involve money, guarantees, or obligations—but that assumption often leads to costly mistakes.

The confusion usually arises because both cash and surety are used to secure commitments, whether it’s posting bail, guaranteeing a contract, or backing a legal obligation. However, the way they work, the risks involved, and their financial impact are very different. Although they look/sound similar, they serve completely different purposes.

In this guide, we’ll clearly explain cash vs surety, how each works, when to use them, and how to decide which option is best for your situation.

What Is Cash?

Cash refers to physical money or readily available funds used to pay, secure, or guarantee an obligation directly—without involving a third party.

Meaning and Definition

In legal and financial settings, cash means money paid upfront to fulfill a requirement. This could be paper currency, bank funds, or certified payments such as cashier’s checks.

How Cash Is Used

In discussions about cash vs surety, cash is commonly used when:

- Posting cash bail in court

- Making security deposits

- Paying fines or fees upfront

- Providing immediate financial guarantees

Cash is simple: you pay the full amount yourself, and no intermediary is involved.

Where Cash Is Used

Cash is universally accepted and used worldwide. There are no regional grammar differences between US and UK English—the word “cash” is standard everywhere.

Example Sentences

- “He paid the full bail amount in cash.”

- “Cash is often required for immediate legal obligations.”

- “When comparing cash vs surety, cash requires full payment upfront.”

Short Historical or Usage Note

The use of cash as a guarantee dates back thousands of years, long before banks or insurance systems existed. It remains the most straightforward—but often the most financially demanding—option.

What Is Surety?

Surety refers to a legal promise or guarantee made by a third party (the surety) to take responsibility if the primary party fails to meet an obligation.

Meaning and Definition

A surety is typically part of a surety bond, which involves three parties:

- Principal – the person or business with the obligation

- Obligee – the party requiring the guarantee

- Surety – the company that guarantees performance or payment

How Surety Is Used

When comparing cash vs surety, surety is used in:

- Bail bonds

- Construction contracts

- Court-required guarantees

- Government licensing

Instead of paying the full amount, the principal pays a small premium, and the surety backs the obligation.

Where Surety Is Used

Surety arrangements are common in:

- United States legal systems

- Construction and contracting industries

- Insurance and bonding markets

There are no spelling differences between American and British English for “surety,” though usage is more frequent in US legal contexts.

Example Sentences

- “The contractor provided a surety bond.”

- “A surety company guaranteed his court appearance.”

- “Understanding cash vs surety can save thousands of dollars.”

Regional or Grammatical Notes

Surety is a formal legal term, mostly used in contracts, courts, and regulated industries rather than casual conversation.

Key Differences Between Cash and Surety

Understanding the difference between cash vs surety is critical when deciding how to secure an obligation.

Key Differences (Bullet Points)

- Cash requires full upfront payment

- Surety involves a third-party guarantee

- Cash ties up personal funds

- Surety preserves cash flow

- Cash carries no ongoing obligation

- Surety creates a legal responsibility to repay if default occurs

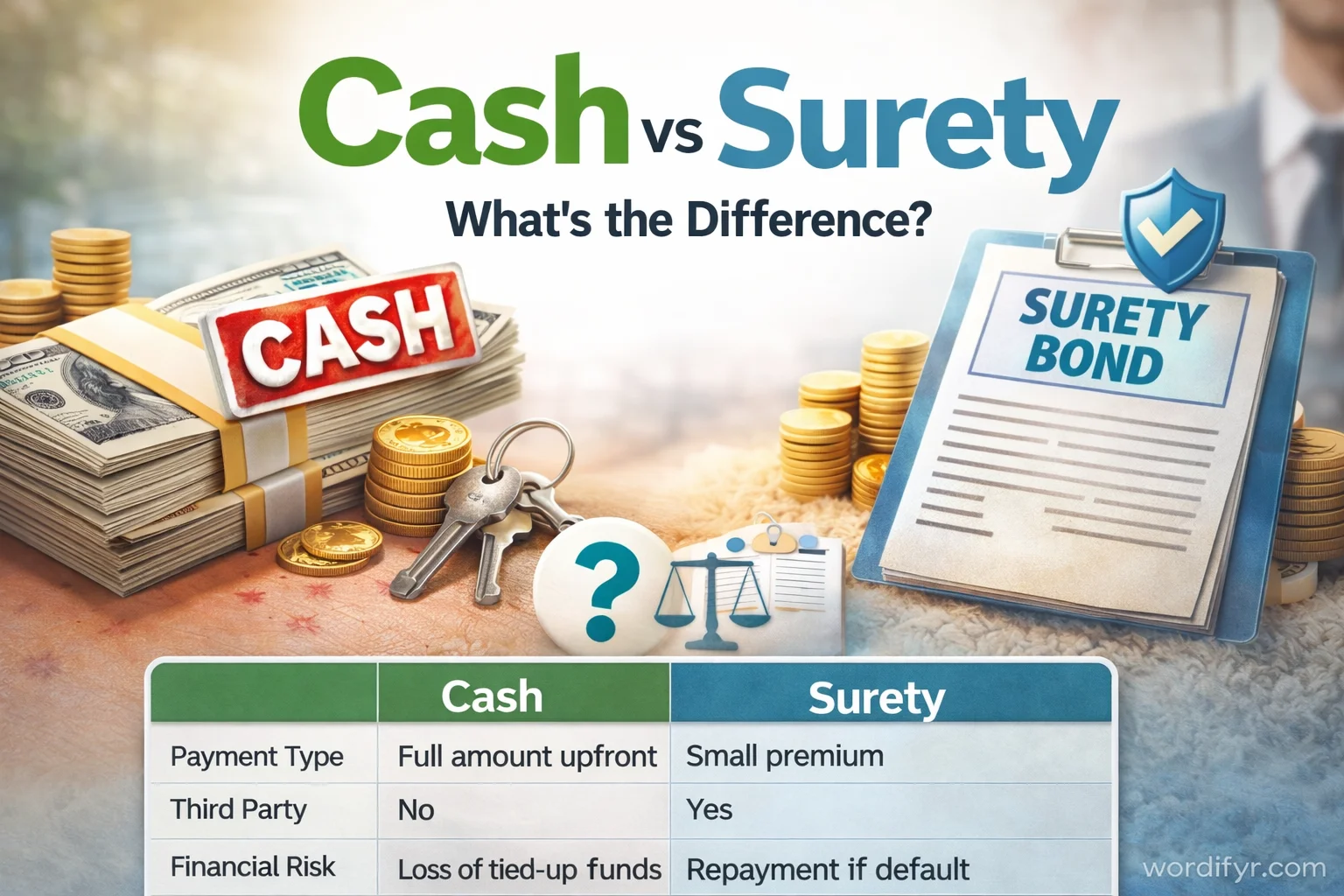

Comparison Table

| Feature | Cash | Surety |

|---|---|---|

| Payment Type | Full amount upfront | Small premium |

| Third Party Involved | No | Yes |

| Financial Risk | Loss of tied-up funds | Repayment if default |

| Common Use | Bail, deposits, fines | Bonds, contracts, bail |

| Cash Flow Impact | High | Low |

| Legal Complexity | Simple | More complex |

Real-Life Conversation Examples

Dialogue 1

A: “Should I post bail in cash or use a bond?”

B: “A surety bond costs less upfront.”

🎯 Lesson: In cash vs surety, surety reduces immediate cost.

Dialogue 2

A: “Why does the contractor need a surety?”

B: “It protects the client if work isn’t completed.”

🎯 Lesson: Surety protects others, not just the payer.

Dialogue 3

A: “I don’t want my money locked up.”

B: “Then surety is better than cash.”

🎯 Lesson: Cash limits liquidity; surety preserves it.

Dialogue 4

A: “Is cash safer than surety?”

B: “Cash is simpler, but surety spreads risk.”

🎯 Lesson: Risk management defines cash vs surety decisions.

When to Use Cash vs Surety

Practical Usage Rules

Use cash when:

- You can afford full payment

- You want no third-party involvement

- The amount is small

- Speed and simplicity matter

Use surety when:

- The required amount is large

- Cash flow is important

- A bond is legally required

- Risk needs to be shared

Simple Memory Tricks

- Cash = Complete payment now 💵

- Surety = Someone else secures it 🛡️

US vs UK Usage

The meaning of cash vs surety is consistent across regions, but surety bonds are far more common in US legal and construction systems.

Fun Facts or History

- Suretyship was used in ancient Roman law, making it one of the oldest financial guarantees.

- Modern surety bonds evolved alongside the insurance industry in the 19th century.

Conclusion

Choosing between cash vs surety depends on your financial position, risk tolerance, and legal requirements. Cash offers simplicity and finality but ties up your money. Surety provides flexibility and lower upfront costs but creates a legal obligation if things go wrong. Neither option is inherently better—each serves a specific purpose. By understanding how both work, you can make smarter decisions, avoid unnecessary risk, and protect your finances more effectively.

Next time someone uses these two words, you’ll know exactly what they mean!