Introduction

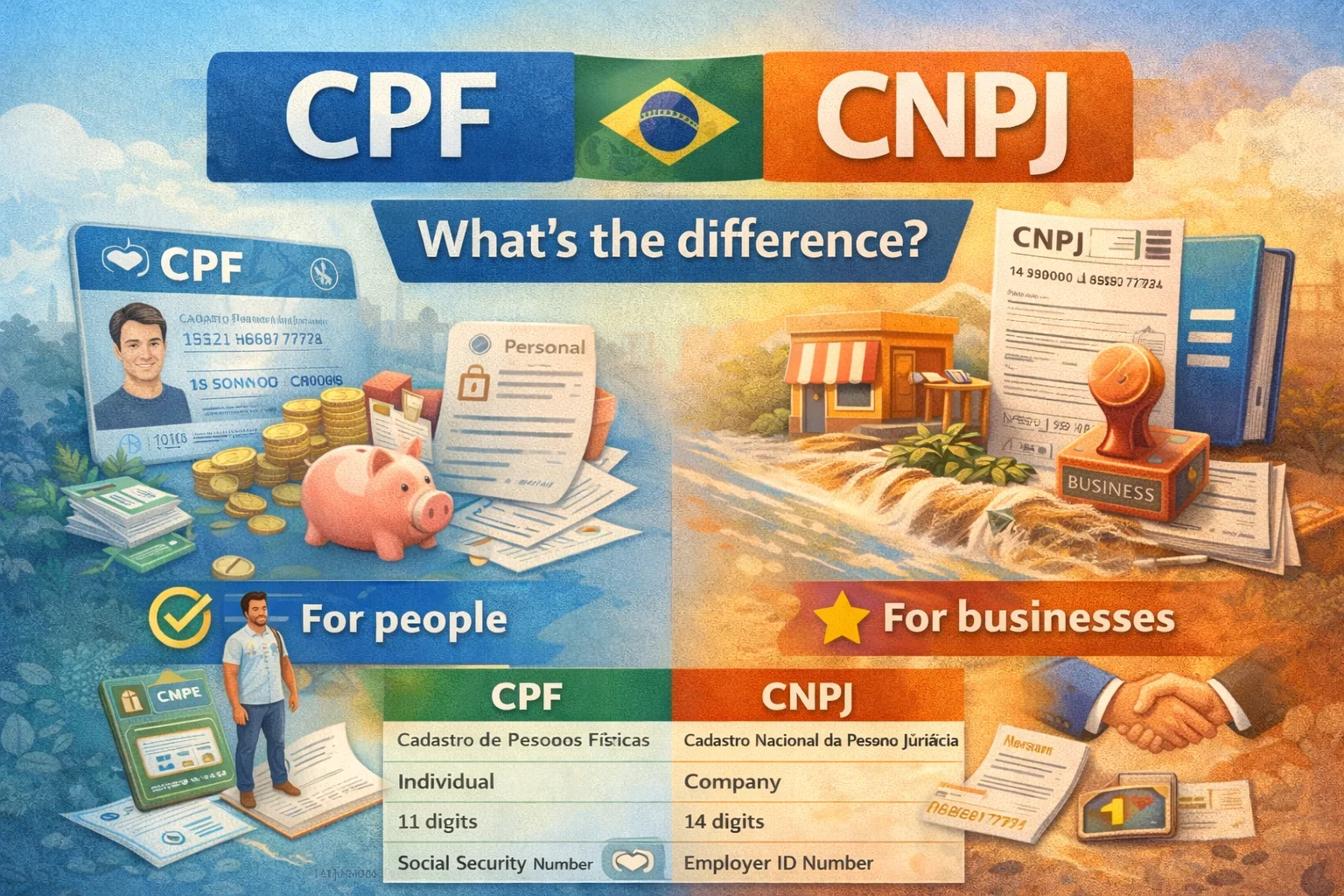

If you’re dealing with Brazil—whether for business, freelancing, online shopping, or legal paperwork—you’ve probably come across the terms CPF and CNPJ. At first glance, they look confusingly similar. Both are numbers. Both are issued by the Brazilian government. And both are required for important transactions.

That’s why many people mix them up or assume they’re interchangeable.

Although they look/sound similar, they serve completely different purposes.

Understanding CPF vs CNPJ is essential if you want to avoid legal trouble, rejected applications, or failed payments in Brazil. One identifies individual people, while the other identifies business entities. In this complete guide, we’ll explain the difference in simple, clear language so you’ll know exactly which one you need—and when. 🇧🇷📄

Section 1: What Is “CPF”?

CPF stands for Cadastro de Pessoas Físicas, which translates to Individual Taxpayer Registry.

Clear Meaning

A CPF is a personal identification number issued to individuals in Brazil. It is used to track a person’s tax, financial, and legal activities.

In the CPF vs CNPJ comparison, CPF always refers to a natural person, not a business.

How It’s Used

A CPF is required for many everyday and legal activities, including:

- Opening a bank account

- Filing taxes

- Buying property or vehicles

- Signing contracts

- Making online purchases in Brazil

- Receiving payments or salaries

Without a CPF, it’s very difficult to function legally or financially in Brazil.

Where It’s Used

- Brazil (nationwide)

- Used by Brazilian citizens and residents

- Also required for foreigners who conduct financial activities in Brazil

The CPF is issued by the Brazilian Federal Revenue Service (Receita Federal).

Examples in Sentences

- “You need a CPF to open a Brazilian bank account.”

- “Her CPF was required for the rental agreement.”

- “In the CPF vs CNPJ comparison, CPF identifies individuals.”

Short Historical or Usage Note

The CPF was introduced to centralize tax identification for individuals. Over time, it became a universal personal ID used far beyond taxes, similar to a Social Security Number in the US.

Section 2: What Is “CNPJ”?

CNPJ stands for Cadastro Nacional da Pessoa Jurídica, meaning National Registry of Legal Entities.

Clear Meaning

A CNPJ is a business identification number issued to companies and legal entities in Brazil.

In CPF vs CNPJ, CNPJ always represents a company, organization, or legal business structure.

How It’s Used

A CNPJ is required for:

- Registering a business

- Issuing invoices (Notas Fiscais)

- Paying corporate taxes

- Hiring employees

- Opening a business bank account

- Signing contracts as a company

Without a CNPJ, a business cannot legally operate in Brazil.

Where It’s Used

- Brazil only

- Used by:

- Companies

- NGOs

- Associations

- Foundations

- Partnerships

Like CPF, CNPJ is managed by the Receita Federal.

Examples in Sentences

- “The company’s CNPJ appears on every invoice.”

- “You need a CNPJ to register as a legal business.”

- “When comparing CPF vs CNPJ, CNPJ is for businesses.”

Regional or Legal Notes

Even sole proprietors and small businesses (like MEI – Microempreendedor Individual) receive a CNPJ, even though they are run by one person.

Key Differences Between CPF and CNPJ

Quick Summary (Bullet Points)

- CPF identifies individual people

- CNPJ identifies business entities

- CPF is personal; CNPJ is corporate

- One person can have one CPF but multiple CNPJs

- Both are required for tax and legal compliance

Comparison Table (Mandatory)

| Feature | CPF | CNPJ |

|---|---|---|

| Full Name | Cadastro de Pessoas Físicas | Cadastro Nacional da Pessoa Jurídica |

| Refers To | Individual person | Company / legal entity |

| Issued By | Receita Federal | Receita Federal |

| Used For | Personal taxes & activities | Business operations |

| Required for Foreigners | Yes (in many cases) | Yes (to run a business) |

| Format | 11 digits | 14 digits |

| Comparable To | SSN (US) | EIN (US) |

Real-Life Conversation Examples

Dialogue 1

A: “Should I give my CPF or CNPJ?”

B: “Are you paying as a person or a company?”

🎯 Lesson: CPF = person, CNPJ = company.

Dialogue 2

A: “I’m a freelancer. Do I need a CNPJ?”

B: “Only if you register a business.”

🎯 Lesson: Freelancers may use CPF unless formally registered.

Dialogue 3

A: “Why was my invoice rejected?”

B: “You used a CPF instead of a CNPJ.”

🎯 Lesson: Invoices require a CNPJ.

Dialogue 4

A: “Can one person have both?”

B: “Yes—CPF for you, CNPJ for your business.”

🎯 Lesson: Individuals and businesses are separate identities.

When to Use CPF vs CNPJ

Use CPF When:

✔️ You’re acting as an individual

✔️ Filing personal taxes

✔️ Opening a personal bank account

✔️ Signing personal contracts

✔️ Making purchases as a private person

Memory Trick:

👉 CPF = Pessoa Física (Physical person)

Use CNPJ When:

✔️ You’re acting as a business

✔️ Issuing invoices

✔️ Paying business taxes

✔️ Hiring employees

✔️ Signing contracts as a company

Memory Trick:

👉 CNPJ = Pessoa Jurídica (Legal entity)

Brazil vs International Context

- CPF ≈ Social Security Number (US)

- CNPJ ≈ Employer Identification Number (US)

This makes CPF vs CNPJ easier to understand for international users.

Fun Facts or History

1️⃣ Everyone in Brazil Has a CPF

From newborns to retirees, CPF is widely used as a lifetime identifier.

2️⃣ Businesses Can’t Hide Without a CNPJ

All registered businesses are publicly searchable by their CNPJ.

Conclusion

The difference between CPF vs CNPJ is simple once you understand the roles they play. CPF identifies an individual person, while CNPJ identifies a business or legal entity. Both are essential in Brazil’s financial and legal systems, but they are never interchangeable.

Using the wrong one can cause rejected payments, invalid contracts, or legal issues. Once you remember that CPF is personal and CNPJ is corporate, the confusion disappears.

Next time someone mentions these two numbers, you’ll know exactly what they mean! ✅